Traditional 401k to roth 401k conversion tax calculator

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. For some investors this could prove.

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

. Compare 2022s Best Gold IRAs from Top Providers. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Contributions to a Traditional 401 k plan are made on a pre-tax basis resulting in a lower tax bill and higher take home pay.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. The amounts may be. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert.

401k IRA Rollover Calculator. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Traditional 401 k Calculator.

Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Schwab Is Here To Answer Your Questions And Help You Through The Process. Whether you participate in a 401 k 403 b or 457 b program the.

Roth Conversion Calculator Methodology General Context. Consider The Different Types Of IRAs. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

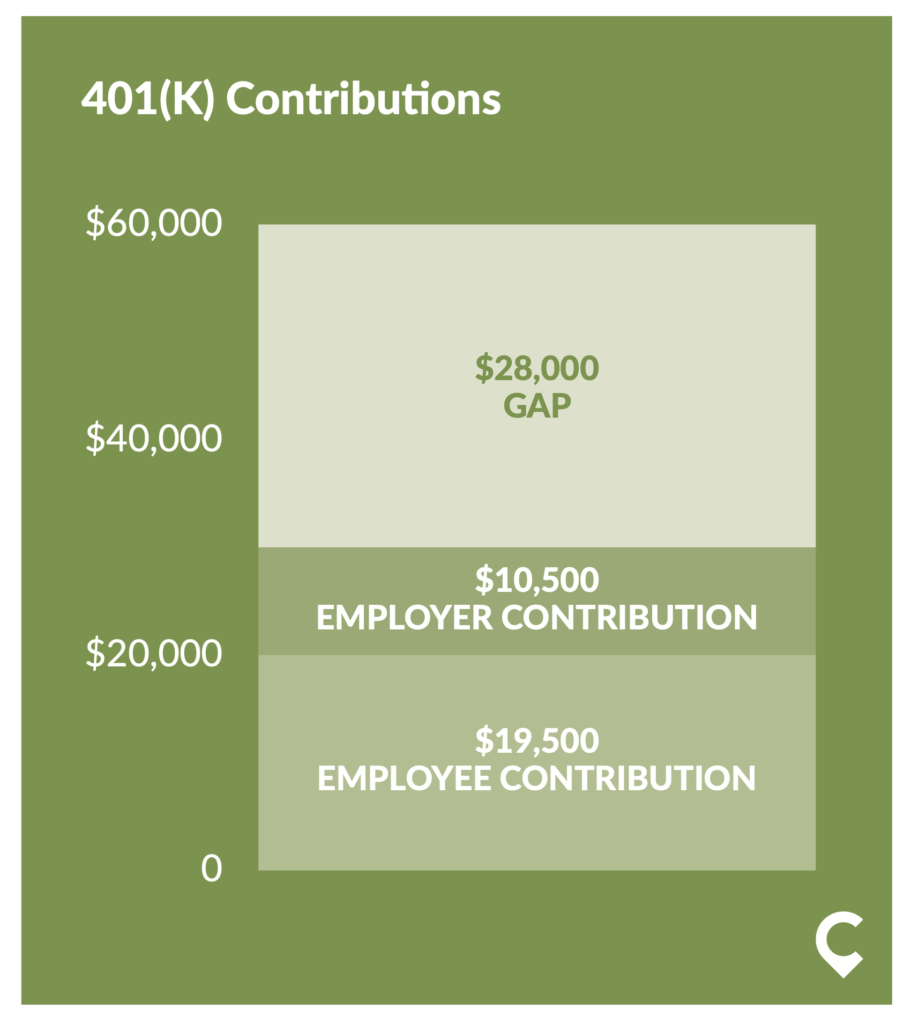

If you are thinking about rolling over and are not sure what option is most financially beneficial we can help you. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. 19500 or 26000 in 2021 or 20500 in 2022 with the 6500 catch-up amount.

This calculator will analyze your information and. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

The main drawback of converting a traditional 401k into a Roth 401k is the tax bill that comes with making the switch. Youre going to have to pay taxes on that money. Roth 401 k Conversion Calculator.

Contributions made to a Roth 401 k are made on an after-tax. This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of.

Ad Find Out Whether Converting Is Beneficial For You. Colorful interactive simply The Best Financial Calculators. Reviews Trusted by Over 45000000.

401 k Rollover Calculator. For instance if you expect your income level to be lower in a particular year but increase again in later years. Thats because the tax benefits of a Roth account are difficult to capture fully with the traditional rule of thumbor even when with the more sophisticated BETR calculation.

This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. Roth 401 k Conversion Calculator. The terms of a registered pension plan that detail the specific amounts that an employer and employee contribute to the plan.

As of January 2006 there is a new type of 401 k - the Roth 401 k. A backdoor Roth 401 k conversion is the transfer of both the pretax and after-tax contributions in a regular 401 k account to an employer-designated Roth 401 k account. Traditional vs Roth Calculator.

Roth IRA Conversion Calculator to Calculate Retirement Comparisons. With the passage of the American Tax Relief Act any. Converting to a Roth IRA may ultimately help you save money on income taxes.

Roth 401 k vs. A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA. A 401 k contribution can be an effective retirement tool.

The contribution limits on a Roth 401 k are the same as those for a traditional 401 k. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

The Bold And Beautiful Roth Conversion Ladder Clipping Chains

Five Reasons To Consider A Roth Conversion Roth Conversation Traditional Ira

The Ultimate Roth 401 K Guide District Capital Management

Systematic Partial Roth Conversions Recharacterizations

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Average 401k Balance By Age Personal Capital

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Traditional Vs Roth Ira Calculator

After Tax 401 K Contributions Retirement Benefits Fidelity

Roth Conversion Q A Fidelity

Traditional Vs Roth Ira Calculator

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

How To Convert Traditional Ira Funds To Roth Solo 401k